- The Money Series newsletter

- Posts

- Time in the Market Vs Timing the Market

Time in the Market Vs Timing the Market

What Happens When You Miss the Best 10 Market Days

Hi Reader,

Welcome to The Money Series and if you are new here, thank you for signing up. Personal finance can feel confusing and overwhelming, but this space is about learning, growing, and figuring it out together, one money decision at a time.

With most things in life, the more effort we put in, the more we potentially get out. Investing, however, often works the opposite way.

As Nobel Prize–winning economist Eugene Fama famously put it:

“Money is like soap. The more you handle it, the less you’ll have.” In other words, excessive tinkering can quietly erode long-term results.

During market booms, many investors begin to anticipate an imminent downturn. After a strong run, gains can feel “too good to last,” leading people to overestimate the likelihood of an immediate correction.

Trying to “time the market” means repeatedly selling when you expect a decline and buying when you think the market is about to rise. That approach has two major drawbacks:

Frequent trading triggers transaction fees, trading fees, and often, capital gain taxes that quietly eat into returns.

In trying to avoid the ‘bad days’, investors often risk missing the best days which tend to cluster around periods of high volatility and market stress.

As an investor, one of the worst habits to have is trying to ‘time the market’. Timing the market is like chasing rainbows; you risk missing the real gains while hunting for perfection.

What the data shows

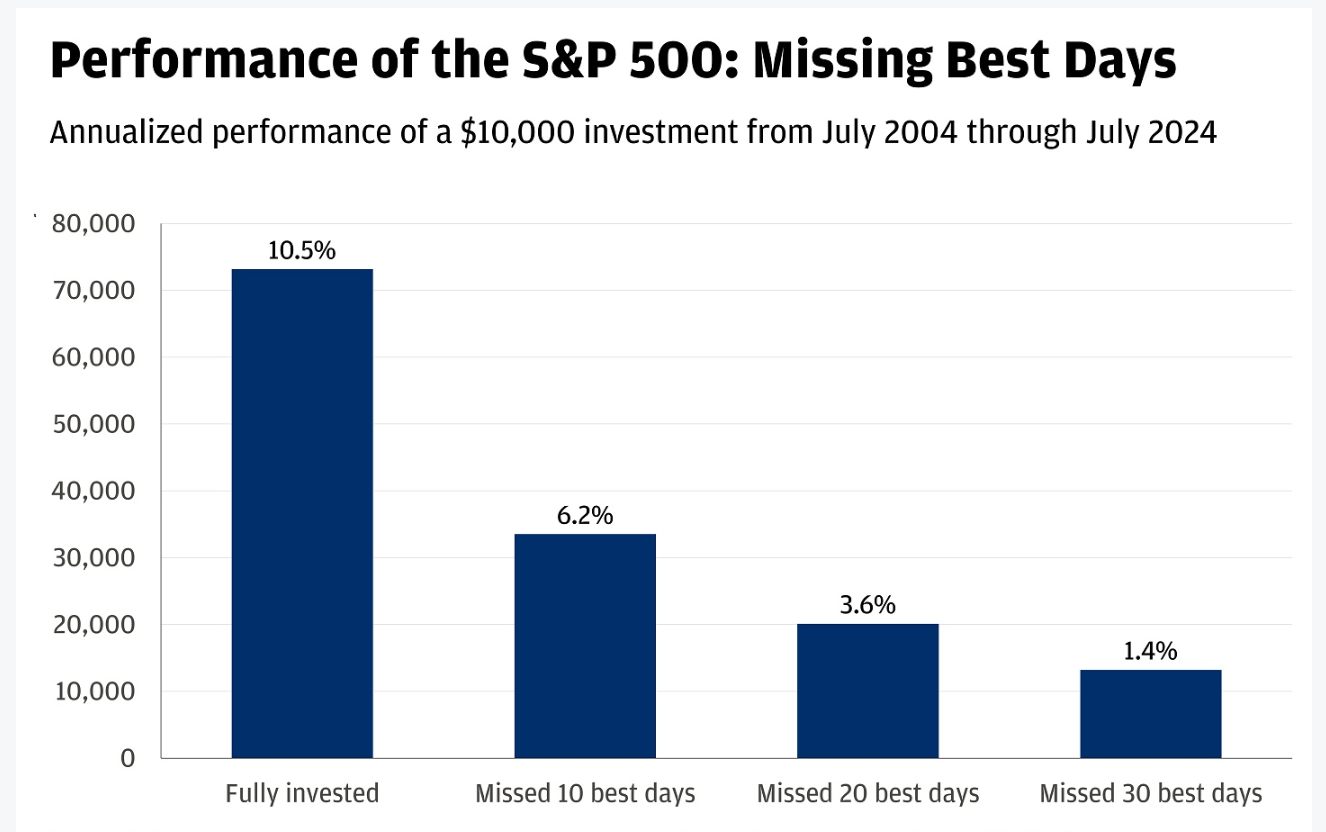

In 2024, JP Morgan Asset Management analyzed S&P 500 performance from July 2004 to July 2024 to study the impact of market timing.

Here’s what they found:

Source: JP Morgan Asset Manangement

Staying fully invested delivered an annualized return of 10.5%.

Missing just the 10 best days cut returns nearly in half to 6.2%.

Missing the 20 or 30 best days reduced returns even further.

Over this 20-year period, 7 of the 10 best days occurred within 15 days of the 10 worst days. In other word, by avoiding downturns, investors often miss the very rebounds that drive long-term wealth.

If you invested $10,000 in 2004 and stayed fully invested through 2024, you’d have over $70,000. Miss just the 10 best days, and you’d end up with less than $35,000. That’s the hidden cost of market timing.

Key Takeaways:

☑️ Best days matter more than worst days. Many of the best market days occur right after sharp declines, exactly when market timers are most likely to exit or stay on the sidelines. Missing these days can severely reduce long‑term returns.

☑️ Market timing requires two perfect decisions. You must know when to get out and when to get back in. Even professional investors struggle to get both right consistently.

☑️ History favors patience. Time and again, buy-and-hold investors outperform those who try to jump in and out of markets. Transaction costs and capital-gains taxes only widen this gap.

As legendary investor Peter Lynch once said:

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

Reflect on This:

How often do your investment decisions come from a long-term plan versus short-term headlines?

Till next week, I am rooting for you, money-ly!

Dee

P.S.: Forwarded this email? Sign up here! Know someone who could benefit from this newsletter? Forward it!

Disclaimer: This does not constitute financial advice. Please conduct your research or consult your financial advisor for important financial advice.